Team Goal

End-to-End DOA Digitization

The team aims to systemize the Delegation of Authority appointment process across all credit units of DBS Risk Management Group, moving from a manual, email-based process to a more automated and unified workflows with centralized database built in for better management.

The Challenge

Driving Cross-Department Alignment

The team must ensure the digitized appointment and management process works across all credit units of DBS Risk Management Group that oversee credit risk of diverse business segments across multiple countries.

My Role

Designing with Impact

As the UX lead, I shaped early-stage discussions into clear, actionable design goals—translating complex business needs into scalable, user-friendly solutions through close collaboration with business, tech, and senior risk stakeholders.

Result and Impact

Efficient Risk Management

DOA Appointment and Governance System has been rolled out to 7+ Risk Management Departments, enhancing management efficiency and accuracy of the approval right for 1000+ credit risk managers.

1. Features Walkthrough

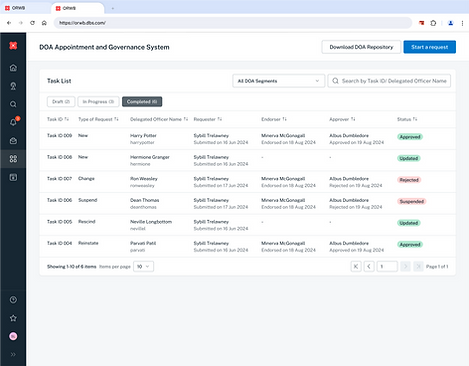

1.1. Task List (MVP 1)

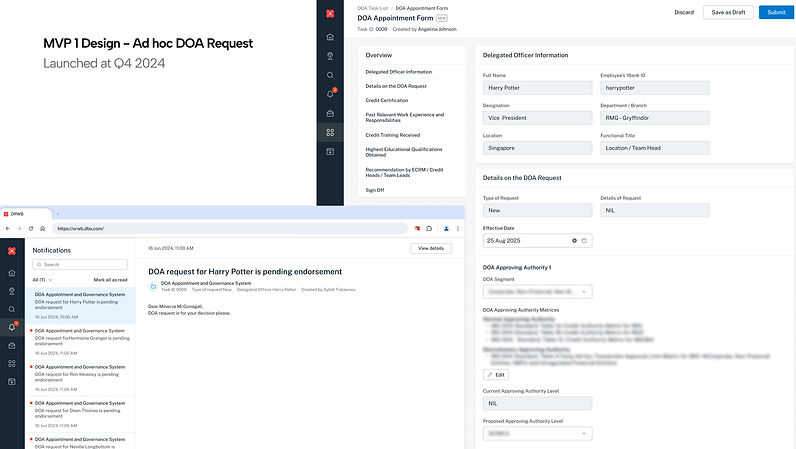

1.2. DOA Ad hoc Request (MVP1)

1.3. Easier approval via email (MVP 1)

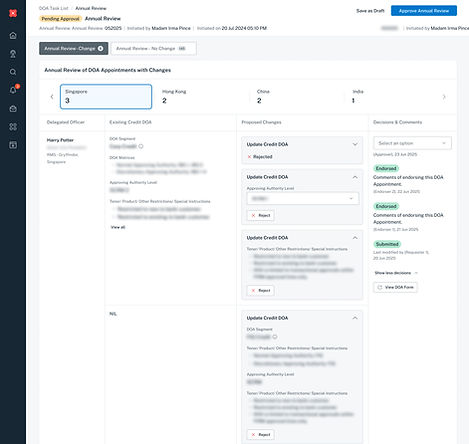

1.4. DOA Annual Review (MVP 2)

2. Background

🚨 What is DOA?

-

Delegation of Authority (DOA) defines who in DBS Bank can approve loans and the maximum limit they can approve, particularly for financial and credit-related transactions.

-

DOA sets out responsibilities and approval rights of credit risk managers, ensuring loans are approved by right people at the right level.

What is DOA Appointment and Governance System?

It is a centralized digital platform streamlining how credit risk managers from all credit units of Risk Management Group are appointed and managed.

What are the Key Capabilities of DOA System?

-

👨⚖️ Ad Hoc Request Management

DOA System ensures all new appointments or changes to credit risk managers’ approval rights, such as modify, rescind, suspend, reinstate, go through an approval process engaging multiple sign-off parties. -

🔎 Annual Review

DOA System facilitates the annual review of existing approval rights across all credit units and automates structured batch review workflows, ensuring loan requests are always reviewed by the right people at the right level. -

📚 Centralized Database

DOA System provides a centralized DOA repository for better management of DOA appointments, replacing previous manual and fragmented systems like SharePoint.

How is DOA Appointment and Governance System Developed and Integrated?

Cross-platforms Integration

Initiated in 2023, DOA System functions with maker-checker flows, with the core built in Global Lending Online Platform (GLOW) and the user interface integrated into GLOW and One Risk Workbench (ORWB) using an unified design system.

Who are the users?

99 Direct System Users

-

Nominated requesters of each risk segment tinitiate DOA requests and submit for endorer's endorsement.

-

Submitted DOA requests must go through sequential endorsements before the final approval.

-

The fully endorsed DOA requests will be sent to approvers for final approval.

Better DOA management of 1000+ Credit Risk Managers

-

Approving authority details of 1000+ credit risk managers are maintained with better efficiency and accuracy by DOA Appointment and Governance System.

3. Deliverables

3.1. DOA Ad hoc Request

A DOA Ad Hoc Request is used to give, cancel, pause, restore, or update a Credit Risk Manager’s Credit DOA.

🔮 Let’s ground ourselves with an example for better understanding of the workflow!

Scenario: Think of DBS Bank as Hogwarts. Harry Potter, the newly appointed Credit Risk Manager needs a special “spell” — his Credit DOA — so he can approve loans for Weasleys’ shop, Wizard Wheezes.

It requires to go through a DOA Ad Hoc Request to get Harry Potter the approval power for the loan. Here's how Ad Hoc Request works:

3.2. Easier approval via email

For ease of approval during hectic schedules or business trips, endorsers and approvers can approve Harry Potter’s card application directly through Outlook email.

3.3. Annual Review

Existing Credit DOAs must be reviewed annually to make sure Credit Risk Managers of all credit units have the right approval power, which can be canceled, paused, restored, updated, increased, or decreased as needed.

🔮 Think of DBS Bank as Hogwarts

Scenario: Credit DOAs of Credit Risk Managers from all Hogwarts Houses are checked every year in an Annual Review.

🚨 The Challenge

DOA System aims to automate the review process, but each credit unit has different procedures and approval requirements.

The Outcome

4. Our Approach

4.1. WHAT were the challenges?

Design at the Helm

As DOA System is a long-term project and there is no permanent PM role in core working group, designer need to proactively stepped into facilitation roles, driving project progress and fostering team alignment.

4.2. HOW might we (designer) drive project progress?

Design as the Bridge

4.3. HOW we collaborated externally with One Risk Workbench (ORWB) core working group?

Design as the Bridge

Me as a designer bridged the gap of cross-functional communications across departments as the core of DOA System was built in GLOW and the user interface were integrated into GLOW and ORWB.

5. The Result

The 1y+ DOA Appointment and Governance System MVP 1 was successfully launched at Q4 2024, digitizing and unifying the manual and decentralized DOA workflows across DBS Risk Management’s credit units.

Verbatim from Key Stakeholders