Consolidated personal financial statement of E.SUN Commercial Bank

Team Goal

1. Unified Financial Statements

Simplified personal account tracking for E.SUN customers by integrated savings, loans, investments, and insurance into a single monthly statement.

2. Taiwan’s First SMS Consolidated e-Statement

Empowered customers to instantly access monthly statements online instead of waiting for mailed PDFs by launching SMS-based e-statements.

3. RWD e-Statement Application Platform

Streamlined the consolidated statement application process across all touchpoints by developing a responsive web platform with clear, guided steps

The Challenge

1. Design grounded in business insight.

Went beyond design to understand business operations, ensuring a truly user-centric experience that also balanced with technical feasibility.

2. Aligning vision, value, and experience.

Balanced business value and user experience by aligning the product with user needs and the company’s long-term vision for optimized customer experience.

My Role

1. Competitor & User Research

Conducted competitive analysis and user research, presenting UX strategy to retail and institutional banking stakeholders.

Led the design of SMS statement, from problem definition to final handoff to developers.

3. Usability Testing

Ensured business requirements aligned with user needs by partnering with UX Researcher to validate designs through user testing.

4. Pre-Launch Product Testing

Improved the launch-ready product by testing and resolving issues before release.

The Outcome & impact

1. Launching MVP within one year.

My teammate and I designed paper, PDF, SMS (RWD web) consolidated statements and an application platform in six months. Products were successfully launched within one year.

2. Elevation of user experience within the bank

Designers elevated UX awareness, prompting the Department of Personal Banking to create a dedicated UX team after the project.

1. Features Walkthrough

Account overview

Savings & Personal loan

Investment & Insurance

Transaction details

2. Background

E.SUN’s customers received multiple paper statements from the bank but they were unable to have a good grasp of their finances because there was no clear overview summarizing their accounts with the bank.

The more products or services our customers applied for, the more statements they would receive. What's worse, our customers would receive several kinds of paper-based or PDF statements designed in various forms separately without an overall report detailing their monthly account activities.

Separate processes and systems used to be in place for the statements of multiple financial products and services to be prepared by different departments on a monthly basis making the operation inefficient.

It was a waste of time, manpower and resources. A unified system that can automatically manage the sending and tracking of statements would be the solution.

3. Solutions

First and foremost―

The consolidated statement and BSM ( Bank Statement Manager )

We combined statements of deposits, personal loans, wealth management, and insurance into one paper-based consolidated statement. Plus, charts which provides visualization summarizing the account holder's assets and loan allow them to get a good grasp of their current assets and monthly expenses. On the other hand, a platform (BSM) used to centrally manage the operation of consolidated statement was built to enable bank tellers to work more efficiently. With this platform, they can easily monitor the sending and returning of statements and customize the advertising banners which are shown on the statements according to customers' consumption habits recorded in the bank's database.

What's more―

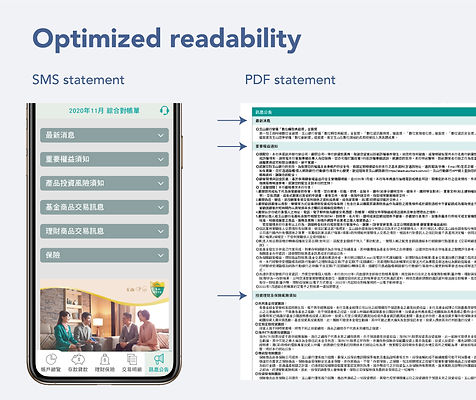

Online statements: access e-statements at any time and go paperless for a greener future!

Making a difference by focusing on environment, society and governance issues has always been the greatest vision of E.SUN. To reduce paper consumption and conserve natural resources, we encourage our customers to apply for consolidated e-statement in electronic or SMS form. The electronic statement is a PDF sent to our customers through email while the SMS e-statement is an online responsive website statement that is sent to our customers through text messages. Both are convenient and secure because they are protected by the customer's ID and our customers can access the e-statement at their convenience instead of going through piles of paper-based statements.

* PDF consolidated statement sent to customers through email

* SMS consolidated statement sent to customers through tax messages

What else can we do to impress our customers ―

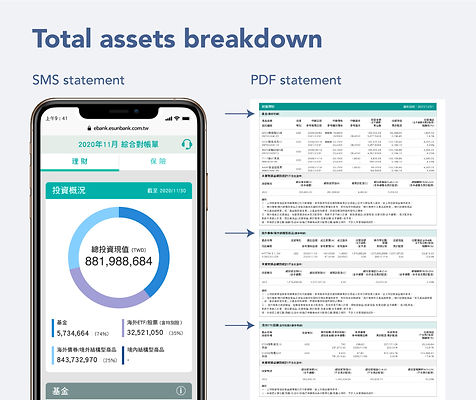

Rolling out the first SMS consolidated e-statement in Taiwan!

E.SUN provided those who are not used to receiving electronic statements through email another option ―

the SMS consolidated e-statement encrypted by customers' ID. With the SMS statement, our customers are less likely to miss their statements among hundreds of emails and can access their statement anywhere at anytime. Compared to the PDF consolidated statement, the SMS statement provides a better user experience on mobile because users don't need to zoom in to check detailed information.

Personal savings

Wealth management

Transaction details

Announcement and notifications

4. Design Process

1

Empathy & Hypothesis

Defining pain points of our bank tellers and customers

2

Ideation

Planning and competitor researching

3

Design

Wireframing and

prototyping

4

Validation

Getting feedback and optimizing the design

4.1. Empathy & hypothesis ― defining pain points

Inconvenience of having multiple statements:

Many of E.SUN’s customers have been complaining that they can't get a snapshot of their overall monthly account activities and current assets from different statements they received according to the customer feedback reports recorded by financial consultants or managers at the branches.

Need to DIY their own statements:

To get a better understanding of their financial position including their assets, those who have been bothered by various kinds of monthly statements usually customize their overall account overview on Excel themselves

"I thought I was using E.SUN app and then I realized it is a monthly statement." ― from P0

Illegibility of current statements:

Although most of our customers are used to statements with old format which doesn't offer good readability, some of them ( especially younger generations or non-bankers ) are still overwhelmed with complicated numbers and professional terms on the statement.

4.2. Ideate ― research & planning

4.2.1. Striking balance between business value and customer needs by conducting competitor research:

To roll out a consolidated statement that not only meets the needs of customers but also achieves E.SUN's goal of rolling out MVP within limited time, me along with another designer optimize the product features originally ideated by the project team by analyzing the pros and cons of different consolidated statements adopted by Cathay Bank, Taishin Bank, DBS Bank, and Standard Chartered Bank, etc.

4.2.2. Planning for the account overview:

According to our research, the main difference between ordinary statements and consolidated statements is the account overview which can be categorized into "Balance sheet" and "Dashboard".

Based on the insights discovered through our research, we helped drive the statements towards an user-friendly direction in cooperation with another designer and UXR at the initial stage of the product production after presenting the findings and proposal to the project team ( Department of Retail banking and Institutional banking ).

To developed a consolidated statement that was beyond customers' expectation, we initiated competitor research and categorized account overview on competitors' consolidated statements into:

A. Balance sheet

Providing a clear overview of users' financial position including assets and loan on a monthly basis.

Taipei Fubon Bank

CTBC Bank

B. Portfolio dashboard

Asset allocation charts allow users to review their assets and investment easily.

Cathay Bank

Standard Chartered Bank ( Hong Kong)

Optimed original prototype of consolidated statement that was merely a combination of statements for different purpose ideated by the project team.

4.2.3. Planning for the SMS statement:

I was mainly responsible for the design of SMS consolidated e-statement in this project. As a whole new product to the bank, it was essential to make it clear that: What makes SMS e-statement stand out from paper-based or PDF e-statement which our customers are already used to, prompting them to try this "new product"?

Visual hierarchy for better UX

Get the whole picture of one’s account activities in one glance!

Display what customers really need to know first and hide the section with too much detailed information.

Data visualization for better understanding

Communicate clearly and efficiently !

Charts showing monthly assets summary allow our customers to review their asset allocation effortlessly.

The reason why we focused on delivering the "mobile version" of SMS statement first?

Given that most of our users will receive tax messages and log in to the SMS statement using their mobile phones and few people receive text messages through their tablets or airdrop the SMS statements to their desktops, we decided to build responsive web of which the max width is designed to fit mobile phones and tablets perfectly.

4.2.4. Optimizing the user experience:

To break the stereotype of banks' user interfaces/ products being complicated and outdated, we were determined to develop design an easy-to-use product for our users. Therefore, our ultimate goal was to strike a balance between usability, simplicity, and visual aesthetics.

4.3. Design ― wireframing and prototyping ( SMS statement )

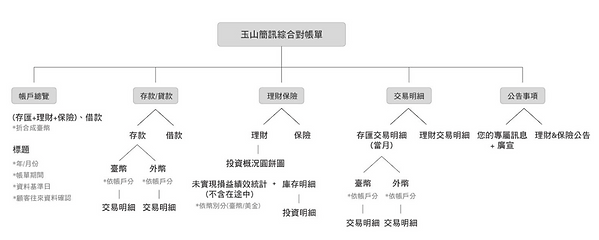

4.3.1. Functional map and user flow:

Bound by the regulations and limitations of existing database, the functional map and information architecture of the SMS statement are basically the same as paper-based and electronic statements. Our priority is to help users easily understand where they are, what they’ve found, and where to go to find what they want in the SMS statement, a whole new product with a totally different user experience.

* Paper-based & PDF consolidated statement

*SMS consolidated statement

4.3.2. Wireframe and prototype:

In the design process, we constantly used wireframes and low-fi prototypes to provide visualization for the audience when presenting proposals to the stakeholders. At the final proposal, we created a click-through high-fi prototypes to examine the usability, the overall UI and visual design, and lastly to make sure the final product meets the stakeholders' expectations.

* Wireframes & click-through prototypes provided during proposals and meetings with stakeholders

Click-through prototype

4.4. Validation ― Collecting feedback and optimizing the design

4.4.1. Screening for suitable interviewees:

In a joint effort with user experience researchers (UXR), we created online questionnaires and sent them to customers who have received statements of deposits, personal loans, wealth management, or insurance in recent months. Among them, those who had at least more than one wealth management product were selected as interviewees because wealth management section was a major part in our consolidated statements.

4.4.2. Setting clear objectives to be achieved through user interviews:

It was clear that validation through user testing were required to ensure the design of consolidated statements meet our customers' needs and to investigate reasons which motivated those who originally received paper statements to apply for e-statements (PDF statements or new SMS statements).

4.4.3. Collecting feedback, sparking new ideas, and optimizing the original design:

Bearing in mind the above mentioned objectives which we want to validate, we (designers, project managers, and a few stakeholders from the bank) took part in the usability testing led by user experience researchers. As observers in the user testing, we recorded what we heard and saw from the monitor and held debriefing sessions to compile all feedback and reach alignment with our project managers on the improvements to be made for the optimization of user experience.

As a designer of the SMS statement, the following feedback from users provided me with insights on what to improve on with the original design to enhance the user experience:

Insights A

It's crucial to be able to clearly distinguish SMS statement from E.SUN app since they both look like an "app."

Recommendations

A.1. From UI perspective: Although it's important to keep the design consistent among different digital products offered by the bank, it is suggested that we distinguish SMS statement from E.SUN app by applying different UI style. Otherwise customers are less likely to tell the difference between consolidated SMS statement showing account overview of last month and E.SUN app providing "real-time" record of account activities.

"I thought I was using E.SUN app and then I realized it is a monthly statement." ― from P0

* E.SUN app

* Original SMS statement

* Refined SMS statement after the user testing

A.2. From usability perspective: Keep the navigation of SMS statement simple.

"To me, there shouldn't be too much time spent on navigating or scrolling to find the statement that is meant to be skimmed through quickly and roughly. If the statement is as complicated as an app, why not checking the E.SUN app showing real-time data instead ?" ― from P4

Compliment

From feature/ function perspective: Asset allocation chart providing consolidated overview of monthly account activities and the current investment make the SMS statement stand out from E.SUN App.

"I really like the asset allocation chart on the investment page. It is crucial to me but the E.SUN app doesn't have it." ― from P0

Insights B

The SMS statement should be friendly enough to older users since the age of our target users ranged from 40 to 60.

Recommendation

To allow our target users to get from start screen to the result they're looking for quickly and easily, it is necessary to increase the size of fonts and buttons, keep the scrolling or navigating simple, and create a clear content hierarchy in the SMS statement.

"Compared to arrow buttons in the account overview section, buttons providing clear explanation of what will happen next in the loan section is much more friendlier to those who are unfamiliar with tech things." ― from P3

"The font size should be bigger." ― from P5

"I don't quite understand what account overview page is about. The only thing I know is there are lots of information on this page." ― from P5

Insights C

The reason why customers should apply for SMS statements instead of continuing to receive paper/ PDF statements should be evident.

Recommendation

The way used to promote SMS statements should be carefully planned beforehand and benefits of updating original statements to SMS statements should be clearly pointed out.

"I am willing to apply for the SMS statement. Compared to traditional statements that are full of numbers and complicated descriptions, I can hide detailed information and only check what really matters to me with the SMS statement." ― from P1

"I will probably update subscription service from original PDF statements to SMS statements because now I've tried it in person and the experience of reading SMS statements on my phone is better than the experience of reading PDF statements with a small screen. However, I would be a bit hesitant to apply for SMS statements because I've been used to the original statements." ― from P4

05 Consolidated Statement Application Platform Design & Development

We highly value the "overall user experience" of the consolidated statement and take every touch point of the user journey into consideration.

In addition to the user experience of the SMS e-statement itself, the experience of the whole user journey is what we value the most. Since the bank offers numerous products and services which our customers can apply for, we want to make sure the application guide and process is clear and simple enough for them.

Besides the UI and UX design of the consolidated statement, I was responsible for the design and development of its application platform, which is a responsive website embedded in the current E.SUN Bank's official website.

Check out the application website of E.SUN Bank's consolidated statements

06 The Future

What else can be improved?

6.1. How to entice our customers who currently receive PDF statements to apply for SMS statements and what makes the SMS statement stand out from paper or PDF statements?

Updating the user experience: Receive SMS statements not only through tax messages but also through email.

Since it is inconvenient to check PDF statements on mobile phones, the SMS statement, a responsive website currently designed for mobile and tablets, should be accessed through both email or tax messages in the future so that users won’t be limited to checking their statements on devices on small screens.

6.2. Since SMS consolidated statement is one of E.SUN Bank's digital products, finding the middle ground between Maintaining consistency in the overall design of the bank's products and distinguishing SMS statements from real-time E.SUN app is what we need to do in the future.